Through the application of core values of responsiveness, transparency, accessibility, fairness and excellence, the Annenberg Foundation is committed to the funding of worldwide organizations and projects that have a deep level of community involvement and tackle challenging and timely problems. Furthermore, the Foundation encourages the development of effective ways to share ideas and knowledge.

The Annenberg Foundation is a private family foundation. Our four-person Board of Directors includes founder Walter Annenberg’s daughter Wallis Annenberg, Chairman, CEO, and President of the Foundation, and three of her children – Lauren Bon, Gregory Annenberg Weingarten, and Charles Annenberg Weingarten – who serve as Co-Directors and Vice Presidents.

The Foundation’s Bylaws establish an Audit Committee and an Investment Committee. The Chairman and the Board of Directors appoint professionals with expertise in investing, accounting, and financial reporting to serve on these committees which report to the Board, but are independent of the Board. Volunteers on these committees are not compensated, but they can direct a fixed dollar amount annually in grants to nonprofit organizations of their choice.

The Annenberg Foundation is required to comply with several regulations and requirements:

Information about our annual grantmaking is available right after each calendar year.

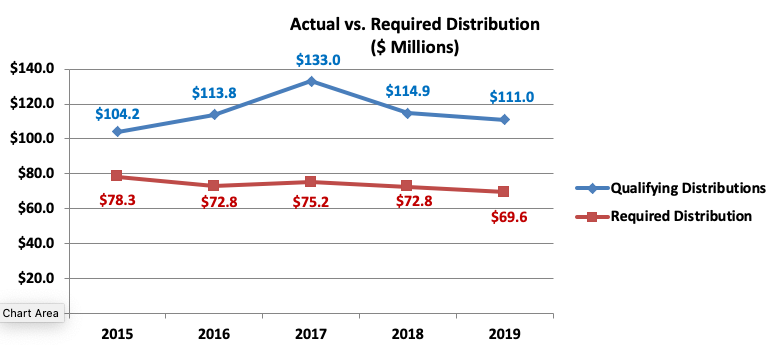

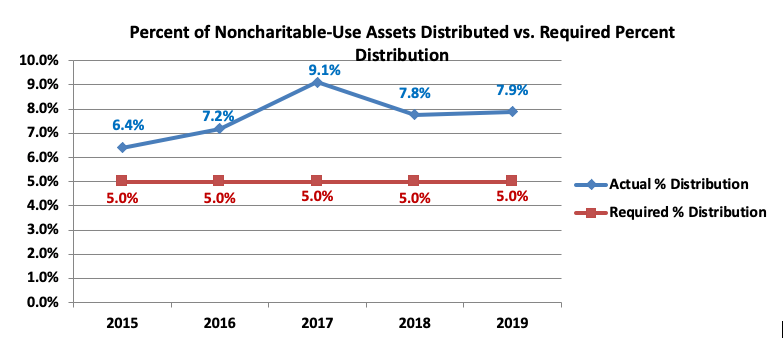

As a private foundation, we are required to annually distribute at least 5% of the net value of our noncharitable-use assets for charitable purposes. Qualified distributions for this purpose include grant payments, charitable expenses paid, and assets purchased for charitable activities. We calculate and report the required distributable amount and our qualifying distributions in Part XI, Line 7 and in Part XII, Line 4, respectively, of Form 990-PF. The Annenberg Foundation generally distributes more than the required 5% each year.

As of December 31, 2019, the Annenberg Foundation’s total assets were valued at $1.47 billion. Our endowment portfolio, which is invested to generate income to support our grantmaking and direct charitable activities, represented $1.33 billion of this figure. As of the same date, our total assets also included $47.9 million of assets held in trust for others and $38.0 million of net property and equipment, inventory, and prepaid excise taxes.

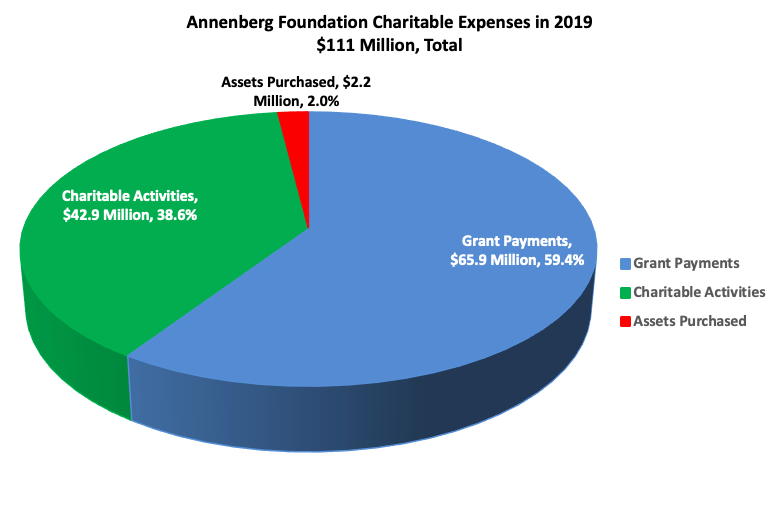

In 2019, the Foundation committed to fund 792 new grants, with a total of $71.5 million approved. Some, but not all, of these new grant commitments were paid out during 2019. The Foundation disbursed $65.9 million in grant payments during the same period and includes payments on grants pledged prior to 2019 and on grants pledged during 2019.

In addition to the $65.9 million in grant payments during 2019, the Foundation paid out $42.9 million to support our direct charitable activities, and $2.2 million to purchase assets used for charitable purposes. Our total qualifying charitable distributions during 2019 were $114.9 million. These disbursements, illustrated in the graph below, are further detailed in our 2019 Form 990-PF, Part I, Column d, and Part XII, the link to which is at the end of this section.

Private foundations must distribute at least 5% of the value of their non-charitable use assets each year for charitable purposes. The Foundation’s 2019 total qualifying distributions represented 7.9% of the Foundation’s investment assets. Although we were required to distribute $69.6 million in 2019, our actual qualifying distributions were $111.0 million. The two graphs below show the Foundation’s annual distributions both in dollars and as a percentage of its investment assets over the past five years.

The sole focus for most foundations is granting funds to qualified nonprofit organizations. The Annenberg Foundation is a little different. In addition to our extensive grant making activities, we also operate several strategic programs. These charitable programs are described in detail in our Form 990-PF and are summarized below.

Annenberg Space for Photography was a cultural destination dedicated to exhibiting both digital and print photography in an intimate environment. The space featured state-of-the-art, high-definition digital technology, traditional prints by some of the world’s most renowned photographers, and a selection of emerging photographic talents. The venue — an initiative of the Annenberg Foundation and its trustees — was the first solely photographic cultural destination in the Los Angeles area, creating a new paradigm in the world of photography.

Annenberg Learner funds and distributes educational video programs – with coordinated online and print materials – to advance excellent teaching in American schools and for the professional development of K-12 teachers. Many programs are also intended for students in the classroom and viewers at home, with videos that exemplify excellent teaching. Annenberg Learner also partners with impactful organizations to provide other means of achieving this goal. K-12 educators, students, and lifelong learners may access Annenberg Learner resources for free at Learner.org. Colleges and universities must purchase a license to use Learner materials in their courses.

Metabolic Studio LLC explores self-sustaining and self-diversifying systems of exchange that feed emergent properties that regenerate the life web. By producing devices of wonder, Metabolic creates the potential for transforming social, political, and physical brownfields into healthy and productive living systems. Major projects include free public programming and workshops, community projects in the Owens Valley connecting the city of Los Angeles to a major source of its water, and a reconnection of the Los Angeles River to its original historic floodplain.

Explore LLC is a philanthropic multimedia organization that documents leaders around the world who have devoted their lives to extraordinary causes. Both educational and inspirational, explore creates a portal into the soul of humanity by championing the selfless acts of others. Explore’s growing library consists of more than 250 original films and 30,000 photographs from around the world. Explore’s work is showcased at film festivals, on over 100 public broadcast and cable channels, and on numerous online destinations including explore.org, YouTube, Facebook, Amazon, and Instagram.

Explore features a wide range of topics—from animal rights, health and human services, and poverty to the environment, education, and spirituality. Delivered in short, digestible bites, explore films appeal to viewers of all ages, from children learning about other cultures for the first time to adults looking for a fresh perspective on the world around them.

Individuals and organizations featured in many explore films also receive explore funding in the form of Annenberg Foundation grants. To date, over $101 million has been awarded to over nearly 300 non-profit organizations worldwide.